Their tax rate isn’t the real issue. The fact that they extract that much wealth out of the labor and production of others is the real problem.

No human being should have a billion dollars. The workers who got you to your level of privilege and status should be paid based on their worth.

A boss that pays fairly would never become a billionaire, and their workers would live good lives being paid the actual value of their labor. Increased demand from increased household discretionary income would create a boom on the supply side.

But it will never happen, because billionaires own everything and will always manufacture consent. Democracy will die to thunderous applause.

Us poors (the dumb ones, because education will be forever castrated) will clap for the billionaires and lay our thrift store hand-me-down jackets over the curb so they can cross a puddle in the street lest they get a drop of water on their 100k elephant skin boots. It’s coming to a head

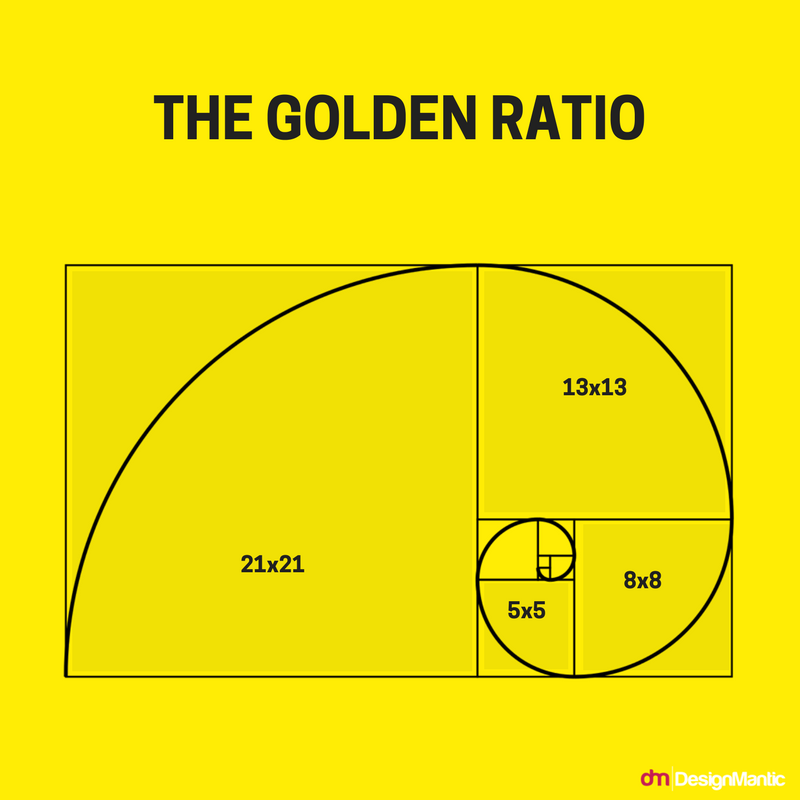

Although this is true, I’d like this graph on a billboard outside every polling location in November:

That there are even billionaires, let alone multi-billionaires. It’s an immoral, unethical system that fundamentally exploited labor that allowed for this.

That productivity has gone up but wages have remained stagnant should boil everyone’s blood. All the wealth stolen and sent upwards into fewer and fewer hands. Legalized theft by way of capitalism.

For the FIRST time? Yeah, no. How about ALL the time?

Did you see a flaw in the analysis? Not sure what you mean

This is something Warren Buffet has been complaining about for years. It’s not exactly a new development.

He’s talked about not paying his fair share. I don’t recall him ever saying “billionaires literally pay a lower effective tax rate”.

From 2012:

https://abcnews.go.com/blogs/business/2012/01/warren-buffett-and-his-secretary-talk-taxes

"Buffett’s secretary since 1993, Debbie Bosanek, sat next to her boss just hours after being invited by the president to the State of the Union address, where the president made her the face of tax inequality in America.

Bosanek pays a tax rate of 35.8 percent of income, while Buffett pays a rate at 17.4 percent."

Idk, I’m not seeing anything there that he acknowledged he paid a lower rate than the average American. He was just contrasting himself with one person. He didn’t say “rich people have a lower effective tax rate than everyone else”. He just says “I have a lower tax rate than this one other person”.

It means that methodologically collected data is less accurate than popular sentiment.

Tax the rich, the banks, and the churches. Then see if you still need anything from the normies.

Removed by mod

Not even our closest cousins would tolerate a member that hoarded bananas so. No, it would be fangs, and ripping and all sorts of face-eating, and a whole bunch of other stuff we should be taking inspiration from.

But it isn’t for the first time. This has been happening for years

That analysis you linked isn’t about income taxes. The NYTimes analysis is just about income taxes. It is the first time, although the report is on data that’s a few years old

Taxing billionaires will just get rolled back, the problem is Capitalism itself.

Collectivize the Means of Production.

Great article. Nice to see an economist doing such important work. I don’t really understand finances. I snipped the parts of the article that helped me understand the finding/headling. There’s a great chart in the article of taxation differences since the 1960s too - staggering! Plutocracy in action!

Published in The New York Times with the headline “It’s Time to Tax the Billionaires,” Zucman’s analysis notes that billionaires pay so little in taxes relative to their vast fortunes because they “live off their wealth”—mostly in the form of stock holdings—rather than wages and salaries.

Stock gains aren’t currently taxed in the U.S. until the underlying asset is sold, leaving billionaires like Amazon founder Jeff Bezos and Tesla CEO Elon Musk—a pair frequently competing to be the single richest man on the planet—with very little taxable income.

“But they can still make eye-popping purchases by borrowing against their assets,” Zucman noted. “Mr. Musk, for example, used his shares in Tesla as collateral to rustle up around $13 billion in tax-free loans to put toward his acquisition of Twitter.”

We can tax registered securities. Stock holdings. We can take 5% or 50% of all outstanding shares, each and every year, and transfer them to IRS liquidators to be resold in small lots over time.

We can exempt the first $10 million held by a natural person, (which exempts about 99.5% of the populace from the securities tax) and establish a progressive tax schedule that causes the tax rate to exceed average gains when holding more than $100 million worth of securities.

Removed by mod

You are familiar with the concept of democracy, are you not?

Removed by mod

First Tuesday after the first Monday in November.

Removed by mod

Removed by mod

Fat orange and his repuglican crew got it done

Yeah, Trump was standing on the shoulders of giants like Regan, Bush, and Bush to get us into mess. Thanks Republicans!

Do not forget Bill Clinton, he played a huge role. Essentially fulfilling republican dreams of deregulation by joining hands with them. It’s when the Democratic party embraced corporate interests and neoliberalism. Clinton deregulated banking (see Glass-Steagall) which led to the financial crisis and banking/finance today.

Biden didn’t fix 40 years of Republican corruption in 3 years therefore he’s just as guilty, and I’m voting Republican!!! - Average American

moronvotercommenter wasn’t even mentioning time frames involving Biden, but way to play the

victim cardaverage democrat playbook

Sometimes I think we shouldn’t have photoshop.

Then I drink more 🖖🏻

Sisko is the best captain.

Hands down. He tko’d Q… and lived to tell about it.

This is easy to solve. Count the loans as ordinary income. Problem solved.

I had to take an insane amount of loans out to get my nursing license. I’ll be paying them off for over a decade. I don’t like this idea

There are numerous things to make this proposal reasonable.

Count as income depending on amount of loan, nature of collateral, and usage of the loaned money.

A loan taken out against primary residence used for purchase of same residence under a million dollars? Not applicable. Proceeds used for education, within reasonable limits? Not applicable.

When a loan is taxed as income, provide for tax credits upon repayment reconcile ultimate use of “real” income. That way you avoid the “double tax” compliant they keep whining about.

I find the tax loans approach ultimately the most workable approach to close the loopholes.

No, count unrealized asset value as income.

You gained 2 billion in stock value, but didn’t sell? You get taxed on that stock gain.

I can’t support that. I myself once had 20 million in stock options but couldn’t sell it. By the time I could sell it, it was worth zero. Yet you in your system I would have paid taxes on it. Stock fluctuates in value to much. We just need way to force them sell the stock and then tax the stock as ordinary income.

Once it went to zero, it would have been a loss and canceled out?

Well if I had to pay unrealized gains I’d have zero but have to pay taxes on 20 million.

It’s why we don’t do it. It would be overly complicated.

No, you would pay taxes on the unrealized gains of your assets. So if your assets are worth 0, then you pay 0. If they are worth 20mil, then you pay taxes on 20mil.

Just a quick reminder, one of the main principles of capitalism is risk vs reward.

That’s my point. They were worth 20 million. Due to legal restrictions I couldn’t sell. As such I would have to pay taxes on 20 million. When I could sell they were worth zero.

So I would have ended up negative.

Sounds like that stock wasn’t worth the risk then. That’s capitalism in a nutshell brahski, people lose money betting on the market every day.

LOL this isn’t going to last much longer. It’s like comedy at this point, what a trend. The system will break before they’re taxed appropriately.

Doubtful

So what do you see changing any time in the near future regarding this issue?

It will be a tug of war between the right and the left, leaning slightly right on economic issues pretty much forever.

America is basically run by large corporations. I don’t see them just willingly changing course. We will get small wins here and there, but nothing drastic for a long time.

Edit - the spice must flow

Capitalism naturally declines over time, that’s why America and other developed countries have expanded internationally via Imperialism in order to super-exploit the third world for super-profits. Capitalism cannot last forever, eventually third world countries will shake off US influence and the empire will crumble.

I think torches, and pitchforks. We should go old school.

I wish people would say this and mean it. I’m waiting. I think we should actually eat one billionaire to make a point. I’m vegetarian but I’ll take a bite to prove my commitment.

It’s kind of a naive idea though. I used to think it was possible. They will literally just kill us or actively make us poor/homeless/antisocial and make some sort of loophole to make it legal and justified. I wish I didn’t think it was game over for the nation but I think it’s actually a lost cause. And any time I try to talk to someone in hopes they can influence me otherwise they just prove my point and make me want to give up more. It’s like they create a division on purpose, or the benefit of the doubt is that they are too naive or emotional to understand what they are actually doing which is creating more of the people they claim to oppose.

It’s like a natural force that keeps war in constant motion. Nobody is allowed to just “be”. Doesn’t matter if they contribute to society or not. People are disposable to groups and nations. It’s an industry. Probably the one that maintains the backbone or foundation of each group/nation/force.

They used to push for a flat tax where everyone, billionaires and minimum wage workers alike, would pay the same rate. They did one better and now billionaires pay a lower rate than everyone else. Steve Forbes was an idiot. They managed to do it far better than he could have ever imagined when he ran for President in the 90’s. Fucking nepo babies…

Flat tax is an awful idea.

Say they make it 10%

When you make $30k a year, $3,000 has a much higer impact on your finances than someone who makes $3,000,000 and pays $300,000 in taxes. You keep $27,000, they keep $2,700,000. You lose a mortgage payment and a car payment. They have to buy a slightly smaller yacht.

On top of that, as already mentioned, their wealth comes from stocks and other non-wages income. Bezos famously only took $81,000 (I think?) in actual pay for many years, yet he’s one of the richest people on the planet. You think $8,100 in taxes is good enough for one of the richest people while you pay $3k out of your $30k?

Flat tax is a bad idea, and the only ones who want it are the wealthy and those who don’t understand that the wealthy could take whatever salary they want to pay as little tax as possible and just live off stocks, loans, which is how they already avoid paying taxes.

Have a flat tax based on brackets.

5% for x income 10% for x income Top out at 30-40%

Problem solved

I think you forgot the /s or some people won’t get it. Also it should go back to topping out at 90%

A 30% flax tax is higher than the mythical 90%.

The 90% range had so many deductions only 1 person hit it and even then it’s only on the income that exceeds that limit.

A 30% flat tax with no deductions is much more brutal to income but it’s fair.

Ahhh you aren’t using the current definition of “flat tax”. Flat tax is a single rate across all incomes. It still includes deductions, exemptions, credits etc.

I don’t know the correct term for “no deductions tax”. No exceptions? Non adjustable?

Your bracket concept is how it works now.

Flat means no deductions and an equal pay. It can still be done against brackets and be a flat tax.

No brackets work with credits and deductions. Someone with 100k in income could pay zero in taxes. A flat tax makes them pay taxes by removing deductions.

Personally I’d rather see a consumption tax but that freaks most people out.

“A flat tax is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax.” Wikipedia